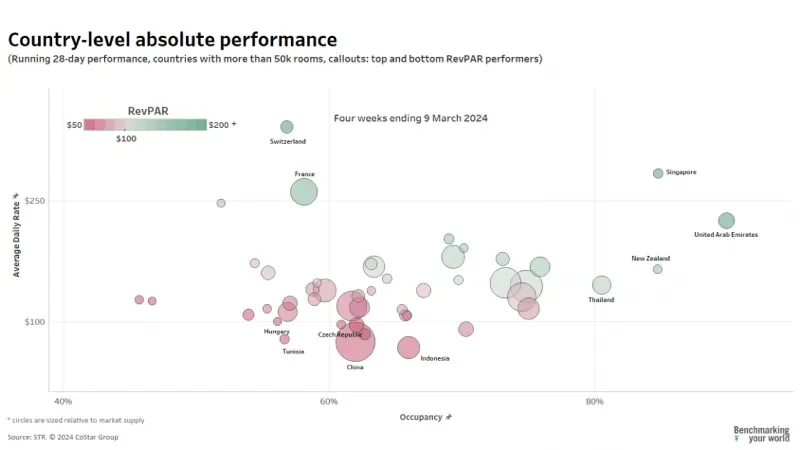

STR's international “bubble chart” upgrade since 9 March 2024 programs that 77% of markets increased income per readily available space (RevPAR) from the equivalent duration in 2023, which was 4% more than the last upgrade. Tenancy and typical day-to-day rate (ADR) were likewise progressively greater than in 2015.

Amongst nations with 50,000 spaces and appropriate hotel reporting levels, Singapore, the United Arab Emirates, France, Switzerland, and New Zealand led in RevPAR on a real basis. Singapore taped the greatest ADR at $284, which was 17% greater year over year as the marketplace hosted Taylor Swift's Eras Tour. Throughout the exact same duration, tenancy increased slightly by 4.6%.

New Zealand signed up with the leader list for the very first time given that this upgrade started years earlier. The nation tape-recorded the greatest tenancy rate (84.8%) towards completion of its summertime season. Significantly, Thailand tape-recorded tenancy above 80%, continuing to exceed its greatest tenancy of the post-pandemic duration.

In general, 36 of 48 nations with hotel supply higher than 50,000 spaces taped development in RevPAR versus 2023.

Omitting nations with changing currency exchange rate, the leaders in year-over-year RevPAR development were Japan, Greece, Malaysia, the Czech Republic, and Singapore. Significantly, Greece and the Czech Republic taped tenancy development of more than 8%, while Japan experienced a small reduction in the metric (-0.1%) however the greatest ADR development (+30%).

Omitting provincial locations and nation markets, the leading 5 entertainers in RevPAR were Macau, Stuttgart, Hokkaido, Sanya, and Frankfurt. Leisure markets in China benefited considerably from the Lunar New Year vacation, with Macau experiencing a 17% boost in tenancy and Sanya seeing a 46% increase in ADR.

While other China markets were affected by the moving calendar impact of Chinese New Year, the majority of the nation's markets experienced drops in both tenancy and ADR. Omitting China's markets, 65% and 75% of markets saw greater tenancy and ADR, respectively, year over year. Ta

This post initially appeared on STR.